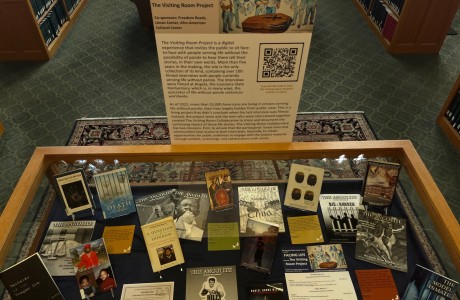

New Books! The International Financial Crisis

In the Main Reading Room of our library we maintain two highly visible bookcases of NEW BOOKS. Among the titles currently on display in one of the bookcases are items about the international financial crisis. Authors include subject specialists, think tank members, academics, and hedge fund managers.

Some of the titles trace the meltdown to American sources. Among these is The Monster: How a Gang of Predatory Lenders and Wall Street Bankers Fleeced America and Spawned a Global Crisis. Another of these is The Great American Stickup, which finds origins of the crisis in the financial/political class who have surrounded such recent American Presidents as Ronald Reagan and Bill Clinton.

Other titles examine the history of the current world-wide gap between wealth and poverty. One example is The Haves and Have-Nots: A Brief and Idiosyncratic History of Global Inequality while another is Trade and Poverty: When the Third World Fell Behind. In this second example, the author investigates economic inequalities between the postindustrial countries of the West and the poorer countries of the Third World. He attributes these inequalities to Third World countries’ exportation of commodities and the West’s exportation of manufactured goods.

Two of our new titles consider the experiences of a particular country. In one of these works, three think tank representatives look at Russia’s financial/economic situation in the wake of the world crisis. These authors predict long-term unviability for Russia’s economic system, if significant institutional reforms are not undertaken. In the second of these works, a hedge fund founder isolates what he perceives as the causes of the presently occurring Greek “Debt Crisis”. He offers three areas for concern: Greek society; EU politics; and the global financial markets.

Finally, two studies try to make predictions about topics in international finance. In one of these studies, The Global Outlook for Government Debt over the Next 25 Years, two members of the Peterson Institute set forth existing data and then extrapolate economic and policy implications. In the second of these studies, a senior fellow at the Peterson Institute investigates sovereign wealth funds. In their lack of transparency and accountability he finds threats to future international financial stability.

Written by Margaret Chisholm